Omnichannel customer journey: The case of payment

According to a McKinsey study, 86% of consumers prefer an omnichannel experience, ensuring a consistent purchasing journey and enhanced proximity with brands that know and recognise them at every interaction.

As the final step in the buying journey, the payment process directly influences store conversions. When successful, it positively impacts customer experience and operational efficiency.

But what does omnichannel payment entail? What are its advantages for retailers? We interviewed Roxane Tranchard, Content Manager at Payplug, a French omnichannel payment solution dedicated to retailers, e-commerce and fintech.

What is Payplug’s vision of omnichannel commerce, and how does it materialise in the payment domain?

RT: At Payplug, we believe all merchants are destined to become omnichannel at some point in their development. To meet current consumer expectations, they need to expand touchpoints (e-commerce site, social networks, physical stores, pop-up stores) while offering a seamless and consistent end-to-end shopping experience. In fact, according to a 2019 study by Salesforce, 73% of consumers expect a unified customer experience from retailers adopting an omnichannel strategy.

In the payment domain, this strategy can take various forms:

- For the merchant: diversify payment options based on sales channels and minimise friction points in the buying journey.

- For payment service providers (PSPs): enable merchants to collect payments wherever they are while unifying payment data for simplified daily management.

Omnichannel payment solutions address these challenges.

What are the advantages of an omnichannel payment solution for merchants?

RT: Using the same solution to accept payments online and in-store has numerous benefits. Firstly, this configuration allows merchants to enhance their customer experience and ultimately improve conversion:

- Online, by offering payment methods tailored to their market and customer expectations: credit card, Buy Now Pay Later, e-wallets, local payment methods and more.

- In-store, by speeding up checkout processes: Payplug’s payment terminals integrate with many point-of-sale software, eliminating manual entry of amounts. Moreover, if the merchant’s cash register system is linked to their e-commerce site, online and offline sales are directly synchronised!

For the customer, this ensures a seamless shopping journey, recognised and able to make a purchase at any time, regardless of the channel used.

With an omnichannel payment solution, merchants can also seize sales opportunities outside their website or store. For instance, after a phone order, they can generate a payment link and send it to the customer via their preferred platform (email, SMS, messaging app).

Furthermore, relying on a single payment partner simplifies payment management. All transactions are synchronised in real-time in a unified back office, allowing the merchant to perform consolidated accounting exports, analyse sales trends and facilitate customer refunds.

Can you provide a use case for omnichannel payments?

RT: Certainly! Let’s take the example of SEAGALE, a digitally-native technical clothing brand that has opened two stores since 2016. It uses Payplug to collect payments on its e-commerce site, in-store and through conversational channels.

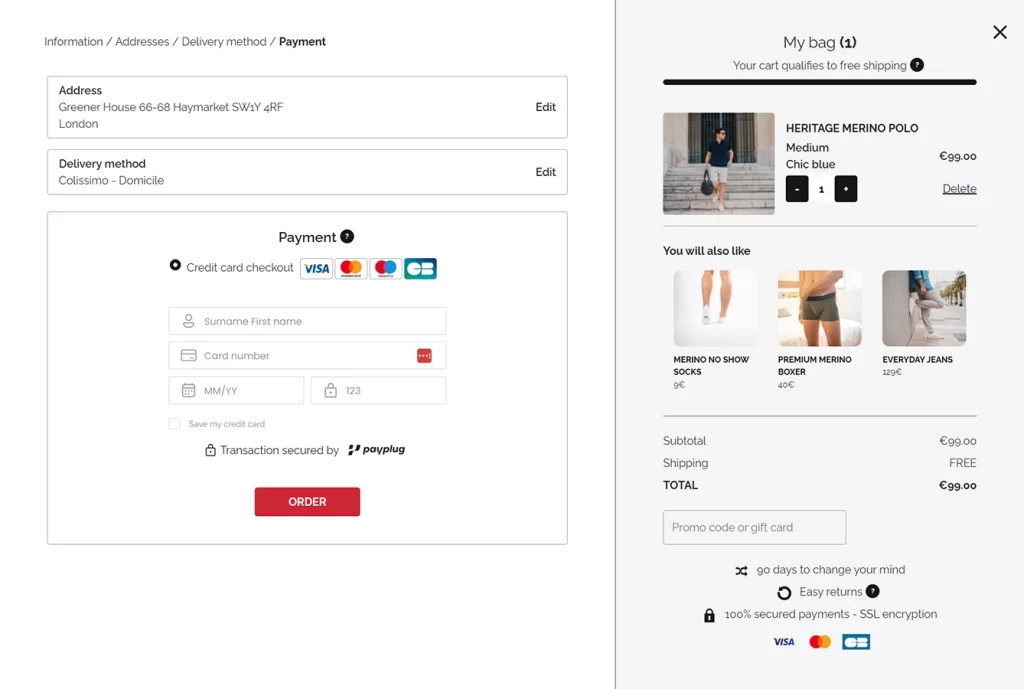

Our solution helps eliminate friction at the payment stage, notably through a fully integrated payment form on the website, reassuring buyers and speeding up the ordering process.

The store regularly sends payment links via SMS or email to customers, recovering sales that might otherwise be lost. It identifies two main scenarios:

- A customer wants to add an item to a recently placed order: after confirming the transaction, customer service adds the product to the order and informs logistics.

- A customer forgets their credit card PIN in-store: with the payment link, they simply enter their card number on a secure payment page.

Subsequently, all transactions are centralised on the same dashboard, whether they come from our payment module or terminals.

In your opinion, what are the major omnichannel payment trends for 2024?

RT: In France, we’re witnessing the rise of digital wallets such as Apple Pay, Google Pay and Samsung Pay: according to the 2023 BPCE Group barometer, mobile payments increased by 163% between 2021 and 2022!

This trend is expected to strengthen with the introduction of innovations like Tap to Pay to the French market, allowing contactless payments with a smartphone, without an additional terminal or hardware. A true revolution for merchants, enabling them to collect payments anywhere and anytime, whether in their store or at external events such as markets and trade shows.

Next year will also see the orchestration of payments, centralising the management of multiple payment services through a single software layer. This allows merchants to implement specific routing rules to direct each transaction to the most relevant PSP (maximising acceptance rates and minimising costs). According to BPCE Group data, among the top 10 e-commerce sites in France, seven have implemented a multi-PSP strategy requiring payment orchestration.

In general, merchants will benefit from interconnecting their business tools—payment solution, POS software, ERP, accounting tool—to unify customer data fully and make the most of their omnichannel positioning.

Our role as a PSP is to help them embrace these trends to maximise performance and remain competitive.

To conclude, what advice would you give to companies looking to improve their payment performance?

RT: I would advise them to choose a solution that controls the entire payment chain, from acquisition to acceptance. This allows action at every transaction stage to minimise risks, facilitate frictionless journeys, and optimise acceptance rates.

As a PSP and acquirer, Payplug covers the entire value chain. Our 360° control of payment data enables us to turn failure risks into conversion opportunities throughout the process.

If you want to learn more about how Payplug can help boost your performance, feel free to request a demonstration from our teams: